In 2022, Verizon, T-Mobile, and AT&T each have a lot of promotional activities for flagship devices, keeping the number of new subscribers at a high level and the churn rate relatively low. AT&T and Verizon also raised service plan prices as the two carriers look to offset costs from rising inflation.

But at the end of 2022, the promotional game starts to change. In addition to heavy promotions on devices, carriers have also started discounting their service plans.

T-Mobile is running a promotion on service plans that offer unlimited data for four lines for $25/month per line, along with four free iPhones.

Verizon has a similar promotion in early 2023, offering an unlimited starter plan for $25/month with a guarantee to maintain that price for three years.

In a way, these subsidized service plans are a way for operators to acquire subscribers. But the promotions are also in response to changing market conditions, where cable companies are stealing subscribers from incumbents by offering lower-priced service plans.

The Core Play of Spectrum and Xfinity: Pricing, Bundling, and Flexibility

In the fourth quarter of 2022, cable operators Spectrum and Xfinity attracted a combined 980,000 postpaid phone net additions, far more than Verizon, T-Mobile, or AT&T. The low prices offered by cable operators resonated with consumers and drove subscriber additions.

At the time, T-Mobile was charging $45 per month per line on its cheapest unlimited plan, while Verizon was charging $55 per month for two lines on its cheapest unlimited plan. Meanwhile, the cable operator is offering its internet subscribers an unlimited line for $30 a month.

By bundling multiple services and adding more lines, the deals get even better. Savings aside, the core message revolves around the cable operator’s “no strings attached” proposition. Consumers can change their plans on a monthly basis, which removes the fear of commitment and allows users the flexibility to switch. This helps consumers save money and tailor their plans to their lifestyles in a way that incumbent carriers cannot.

New entrants intensify wireless competition

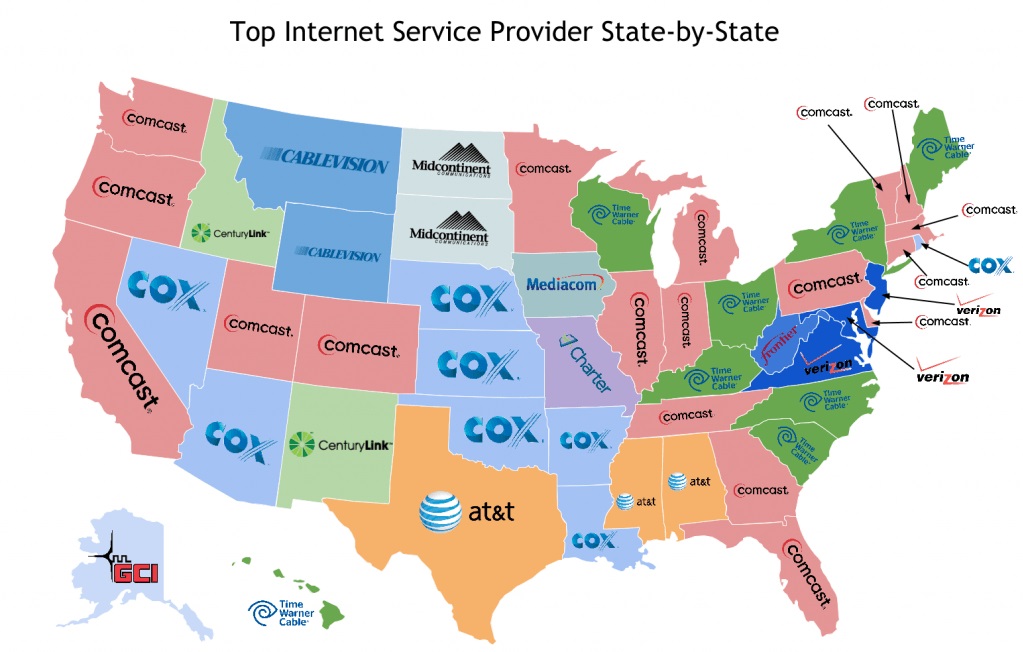

With the success of their Xfinity and Spectrum brands, Comcast and Charter have established a model that other cable companies are rapidly adopting. Cox Communications announced the launch of their Cox Mobile brand at CES, while Mediacom also applied for a trademark for “Mediacom Mobile” in September 2022. While neither Cox nor Mediacom has the scale of Comcast or Charter, as the market expects more entrants, and there could be more cable players to continue from operators if they don’t adapt to suck users away.

Cable companies have been offering superior flexibility and better prices, which means operators will need to adjust their approach to delivering better value through their service plans. There are two non-mutually exclusive approaches that can be taken: Carriers can offer service plan promotions, or keep prices consistent but add value to their plans by adding subscriptions to streaming services and other perks that cable companies will lack to match means or scale. Either way, service costs are likely to increase, which means that the money available for equipment subsidies may shrink.

So far, hardware subsidies, service bundling, and value-added services with premium unlimited plans have been the key factors driving the migration from prepaid to postpaid. However, given the significant economic headwinds operators are likely to face in 2023, including rising debt costs, subsidized service schemes could mean a shift away from equipment subsidies. Some incumbents have already made subtle hints about ending the massive equipment subsidies that have been going on for the past few years. This transition will be slow and gradual.

Meanwhile, carriers will turn to promotions for their service plans to defend their turf, especially at a time of year when churn accelerates. That’s why both T-Mobile and Verizon are offering limited-time promotional deals on service plans, rather than permanent price cuts on existing plans. Carriers, however, will be hesitant to offer low-priced service plans because there’s little appetite for price competition.

As of now, little has changed in terms of hardware promotions since T-Mobile and Verizon started offering service plan promotions, but the evolving landscape still leads to a serious question: how well the two carriers can compete on service prices and hardware promotions? How long will the competition continue. It is to be expected that eventually one company will have to step back.

Post time: Mar-06-2023